Customer Service

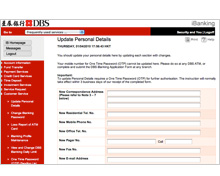

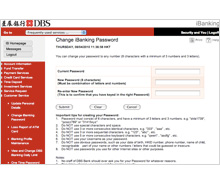

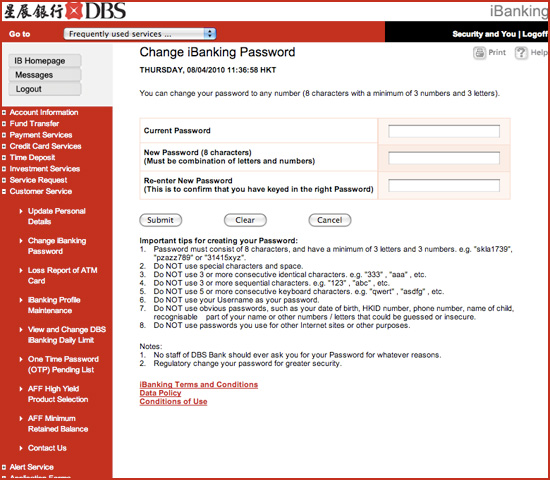

Change Password |

To change your iBanking password. Do change your password regularly (it must be made up of 8 characters with a minimum of 3 numbers and 3 letters). |

|

|

Activate Secure Device |

Please click here for more information. |

|

|

mBanking Password Maintenance |

To create, change or reset your mBanking password, do change your password regularly (it must be made up of 8 characters). |

|

|

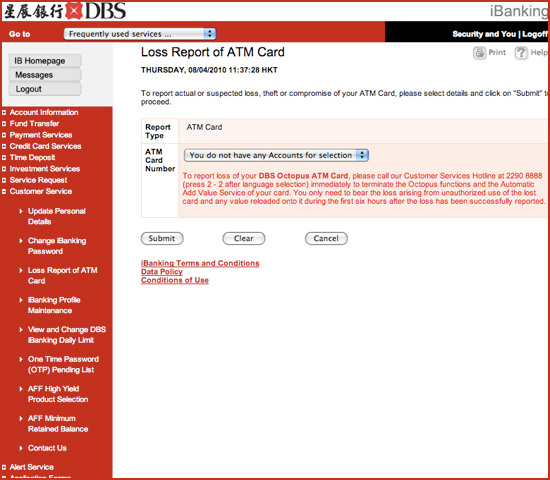

Loss Report of ATM Card |

To report suspected loss, theft or compromise of your ATM card. |

|

|

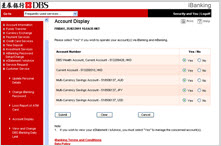

Account Display |

To select the account(s) you would like to manage with iBanking. |

|

|

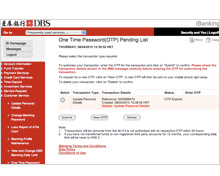

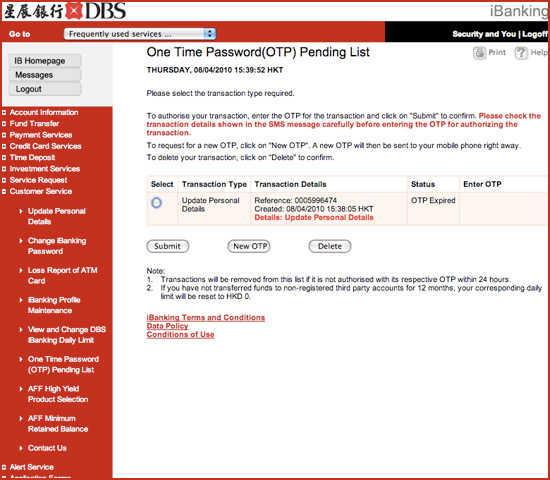

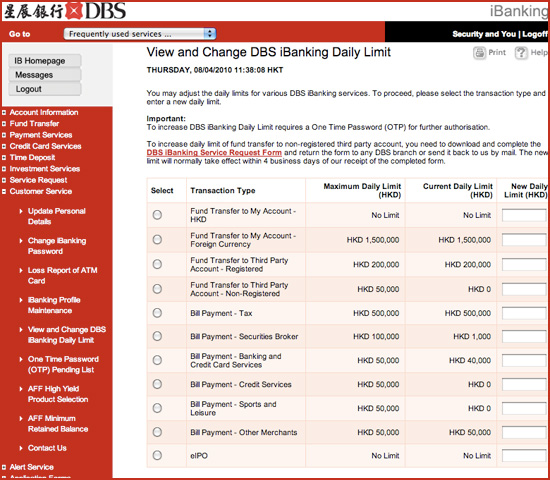

View and Change iBanking Daily Limit |

To view and change your iBanking daily limit, select the transaction type and enter a new daily limit to proceed. An One Time Password (OTP) is required for authorization of an increase in iBanking daily limit. DBS iBanking and DBS mBanking share the same daily limit. But for security reason, in particular if you wish to increase the daily limit of funds transfer to non-registered third party accounts, we recommend that you download the DBS iBanking Service Request Form, complete and return it to any of our branches or send it back to us by mail for processing.

For added security, you are reminded not to set the daily limits at a level higher than you usually need. If you have not transferred funds to non-registered third party accounts for 12 months, your corresponding daily limit will be reset to HKD 0. |

|

|

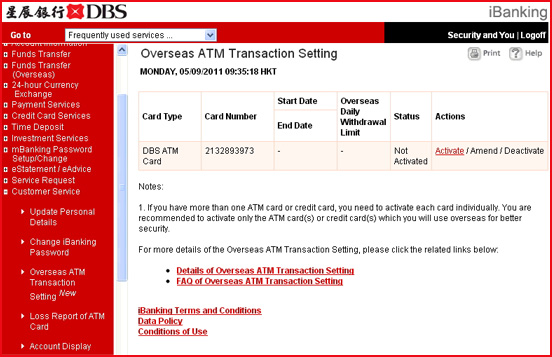

Overseas ATM Transaction Setting |

To enhance security for overseas automatic teller machine (“ATM”) transactions, as mandated by the Hong Kong Monetary Authority, the overseas ATM transaction function (including cash withdrawal and cash advance) for all ATM cards and credit cards will be pre-set as “deactivated” effective from 1 March 2013. If you wish to use ATM services overseas, please activate the function in advance by setting the service start date/end date and the overseas ATM daily withdrawal limit. The activation can be done via DBS iBanking. |

|

|

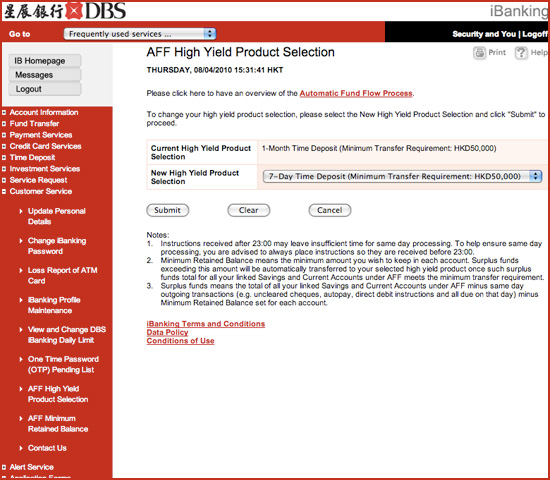

AFF High Yield Product Selection |

To select or change your Automatic Fund Flow (AFF) High Yield Product. You can select the following options:

Note: This function is available only to Treasures Priority Banking Customers who have successfully applied for AFF. |

|||||||||

|

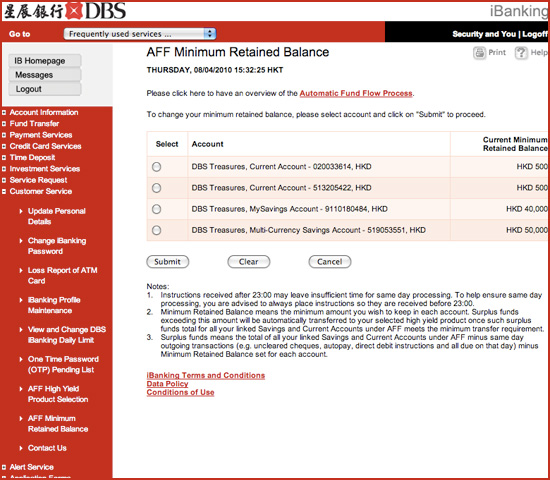

AFF Minimum Retained Balance |

To change the Minimum Retained Balance for your Linked Current and Savings account. Note: This function is available only to Treasures Priority Banking Customers who have successfully applied for AFF. |

|

|

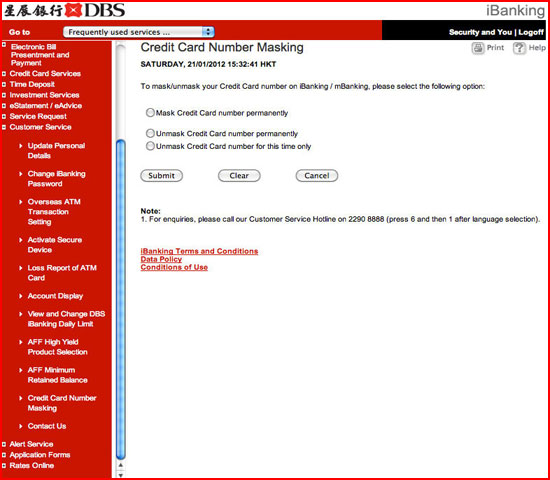

Credit Card Number Masking |

You may select to mask or unmask your Credit Card number. |

|

|

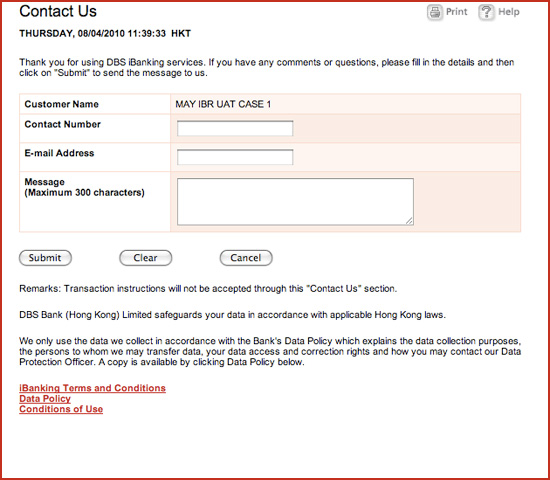

Contact Us |

To provide comments or questions regarding iBanking. Simply fill in the details and click on "Submit’ to send the message to us. Please note that transaction instructions will not be accepted through this function. DBS Bank (Hong Kong) Limited safeguards your data in accordance with applicable Hong Kong laws. We only use the data we collect in accordance with our Data Policy which explains the data collection purposes, the persons to whom we may transfer data, your data access and correction rights and how you may contact our Data Protection Officer. A copy is available by clicking Data Policy below. |

|

|