Funds Transfer

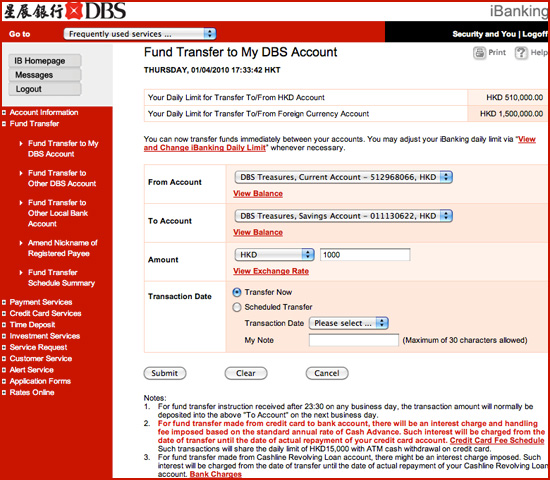

Funds Transfer to My DBS Account  |

You can transfer HKD or other currencies between your various DBS Bank accounts.

|

|||||||||||||||

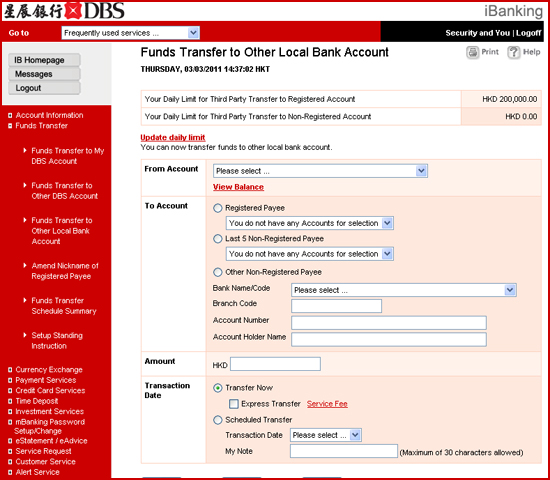

Funds Transfer to Other Local Bank Account

|

You can transfer funds to a third party account held at other local banks in HKD. Funds Transfer to a non-registered third party account requires a One Time Password (OTP) for authorisation.

Please refer to the Bank Charges Schedule for details of service charges. |

|||||||||||||||||||||||||||||||

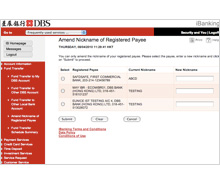

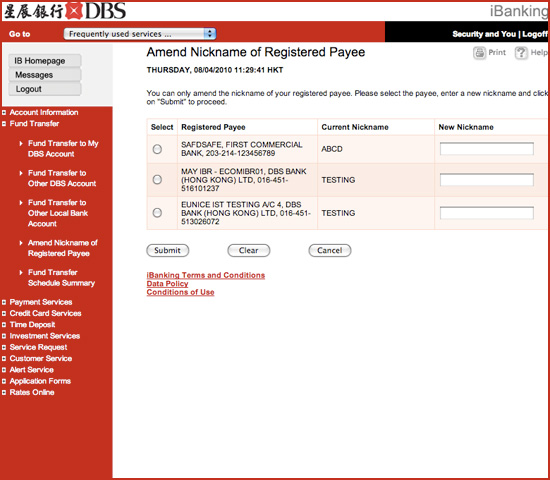

Amend Nickname of Registered Payee

|

You can amend the nickname of your registered third party payee. Please simply select the third party payee and enter a new nickname.

Remarks: DBS iBanking and DBS mBanking share the same registered payee list. |

|

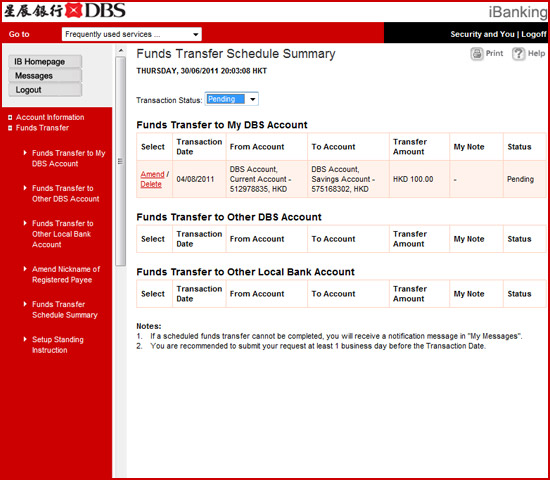

Funds Transfer Schedule Summary

|

You can amend or delete pending funds transfer. Please select the scheduled funds transfer and click on "Submit" to proceed.

You are required to submit your request at least 1 business day before the Transaction Date. You can select "All", "Completed", "Pending", "Rejected" or "Cancelled" scheduled funds transfer(s) in “Transaction status”. You are recommended to submit your request at least 1 business day before the Transaction Date. Remarks: DBS iBanking and DBS mBanking share the same funds transfer schedule summary. |

|

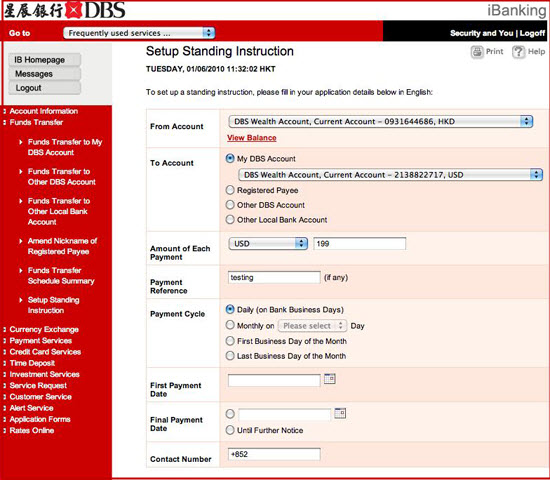

Setup Standing Instruction

|

To set up a standing instruction via iBanking, simply fill in your application details in English and click on "Submit" to proceed. We will normally take 5 Bank Business Days to process your request on setup.

Notes: 1. Where the Payment Cycle is specified to be daily execution: If any Payment Date shall fall on a day which is not a Bank Business Day, the transfer scheduled to be made on that Payment Date will not be executed and cancelled. 2. Where the Payment Cycle is specified to be monthly execution: If any Payment Date shall fall on a day which is not a Bank Business Day, the transfer scheduled to be made on that Payment Date shall be postponed to the next Bank Business Day; but if any Payment Date shall fall on the last working day of the month that is a Saturday, the standing instruction will be executed on the preceding Bank Business Day. If the final Payment Date falls on a day which is not a Bank Business Day, the transfer scheduled to be made on that Payment Date will not be executed and cancelled. 3. Where a standing instruction involves foreign exchange: If the Bank is unable to execute the standing instruction due to insufficient funds in the debit account on any Payment Date, the standing instruction will be terminated and any uncompleted instructions under this standing instruction will not be executed and cancelled. Please refer to the Bank Charges Schedule for details of service charges. If you wish to amend the standing instruction which set up by the Bank, you can click here to download the Standing Instruction Amendment Form, complete and return it to any of our branches for processing. |

|