|

|

Investment Services |

|

|

|

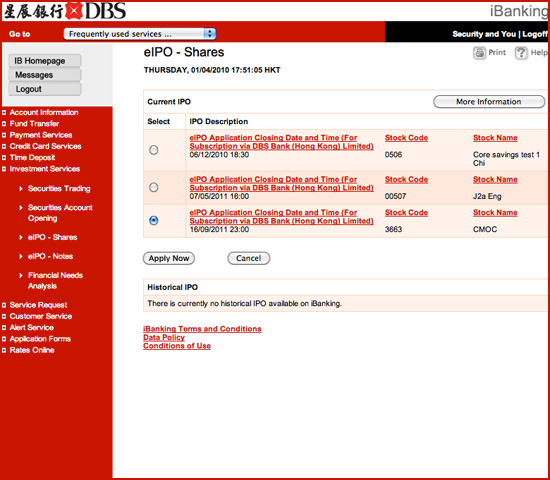

eIPO - Shares

|

|

To online subscribe newly-listed

stocks from Initial Public Offerings (IPO). If you are an iBanking

customer and DBS Bank's single name Packaged Account holder with

Securities Account, you can subscribe your application in DBS iBanking

directly. If you are not an iBanking customer yet or you are not

DBS Bank's single name Packaged Account holder with Securities Account,

the application form is required to personally submit to any of

our branches. |

|

|

|

|

| |

|

|

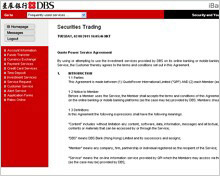

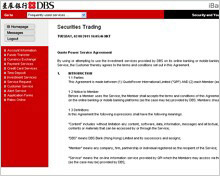

| Securities

Trading |

|

|

Using the Service for the First

Time

|

|

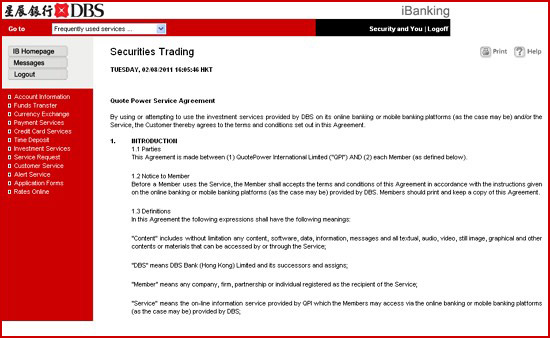

Please read and accept Quote

Power Service Agreement before using the service. |

|

|

|

|

|

|

|

Place Order

|

|

To buy/sell stocks

| |

Select the types of order (Enhanced Limit Order, Market Order ,At-auction Limit Order or Stop Loss Order) in the tab. |

| |

Click 'Buy' or 'Sell' the stock.

* For Stop Loss Order, only the ‘Sell’ option is available. |

| |

Enter stock code. Click on "Code" to search the stock code using stock name. |

| |

Enter “Currency”, "Price" and "Quantity". Click on "Real-time quote" to view the latest stock quote. |

| |

Select "Good Till" date followed by the "Account". |

| |

Click on "Buying Power" to view the available balance for stock trading. (Not applicable to Stop Loss Order) |

|

| |

|

|

|

|

|

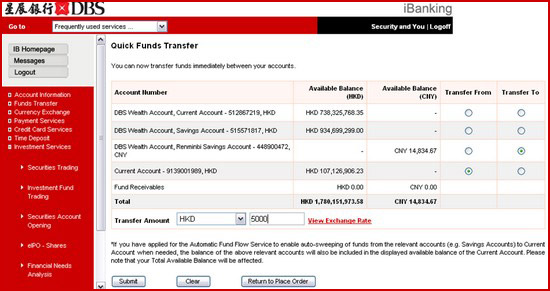

Quick Funds Transfer

|

|

To transfer funds immediately

between your accounts

| |

Select an account of 'Transfer

From' and an account of 'Transfer To' and then input the 'Transfer

Amount'. |

| |

For fund transfer instructions received

after 23:30 on any business day, the transaction amount will

usually be deposited into the receiving account on the next

business day. |

|

|

|

|

|

|

|

|

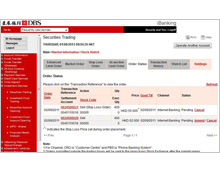

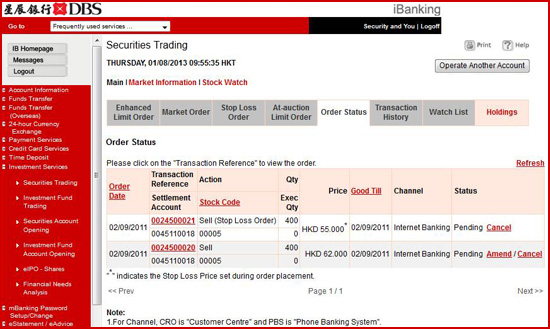

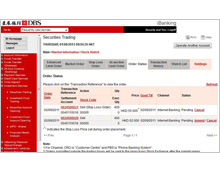

Order Status

|

|

To view the status of your

order

| |

Click 'Transaction Reference'

to view the order details.. |

| |

Click 'Amend' to amend

your order. (Note: ?Market Order? cannot be amended.). |

| |

Click 'Cancel' to cancel

your order. . |

|

|

|

|

|

|

|

|

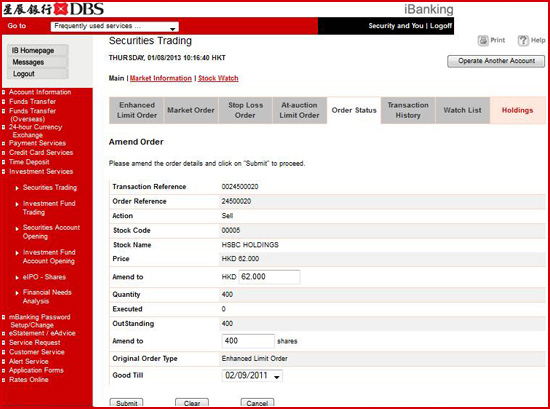

Amend Order

|

|

To amend your order

| |

Click 'Amend' to change

the order on 'Order Status'.. |

Note:

| 1. |

Increasing quantity without

revising the price is not allowed. You may place a new order

in that case and cancel the original one if needed.

|

| 2. |

'Market Order' and ‘Stop Loss Order’ cannot be amended. |

|

|

|

|

|

|

|

|

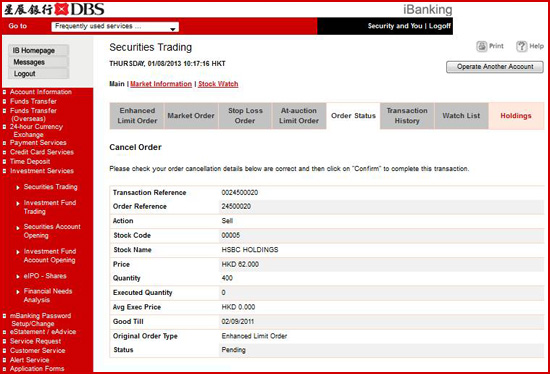

Cancel Order

|

|

To cancel your order

| |

Click 'Cancel' to cancel

the order on "Order Status". |

|

|

|

|

|

|

|

|

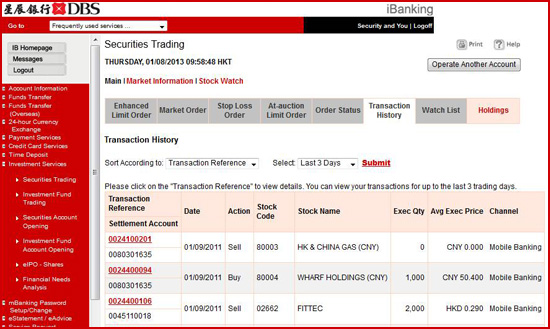

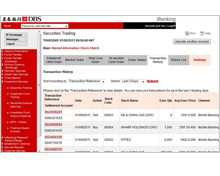

Transaction History

|

|

To view the transaction

history (up to one month)

| |

Select the sorting preference

and period of the transaction history. |

| |

Click 'Transaction Reference'

to view the order details up to the last 3 trading days. |

|

|

|

|

|

|

|

|

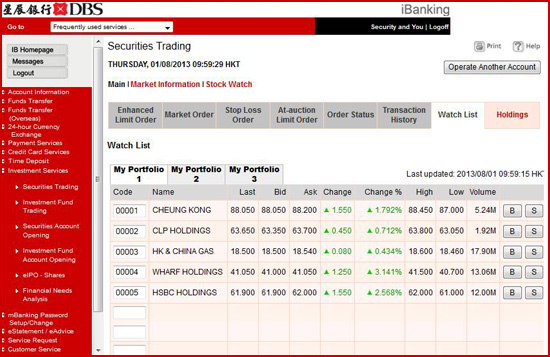

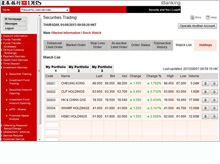

Watch List

|

|

To view your stock portfolio

| |

Click 'My Portfolio' to maintain up

to 3 pages of personal stock portfolios. |

| |

Click "B" or

"S" button to buy or sell the stock |

| |

Input 'Code' and then click

'Refresh' to add the stock to your portfolio. |

| |

Delayed quotes are showed

on the portfolios by default. To show the real-time quotes,

you can select 'Real-time quote' and then click 'Refresh' |

|

|

|

|

|

|

|

|

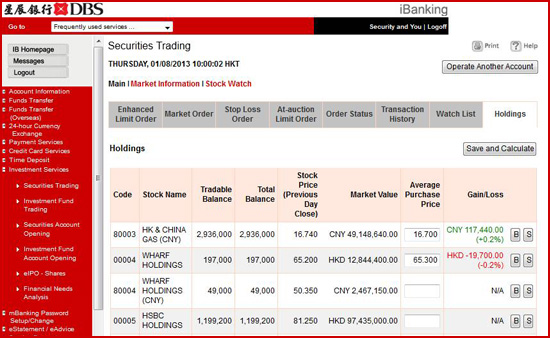

Holdings

|

|

To view the balance of

your stock holdings

| |

Click 'B' or 'S' button

to buy or sell the stock. |

To calculate the gain/loss of your holdings

in a particular stock

| |

Input the average purchase

price of your relevant stock. |

| |

Press “Save and Calculate”. |

|

|

|

|

|

|

|

|

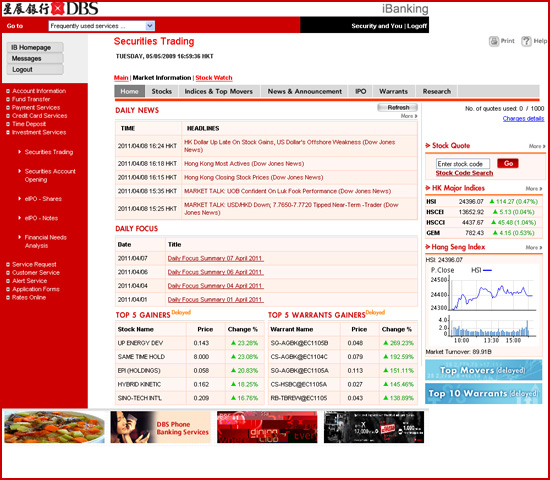

Market Information

|

|

To gain access to comprehensive

market information, including major indices, stock quote, top movers,

research, market news and announcements, warrants and IPO information. |

|

|

|

|

|

|

|

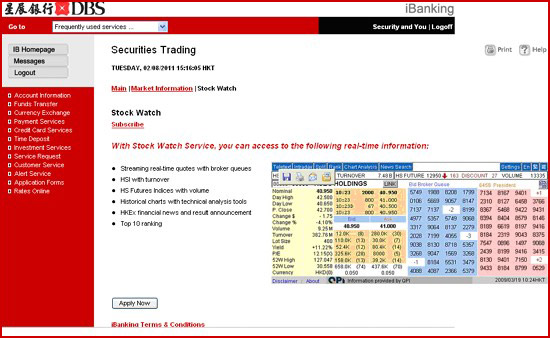

Stock Watch

|

|

To gain access to comprehensive

market information with auto-updated stock quote service. A monthly

fee will be charged for this service. |

|

|

|

|

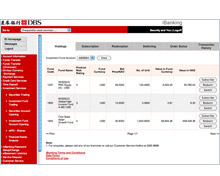

| Investment

Fund Trading |

|

|

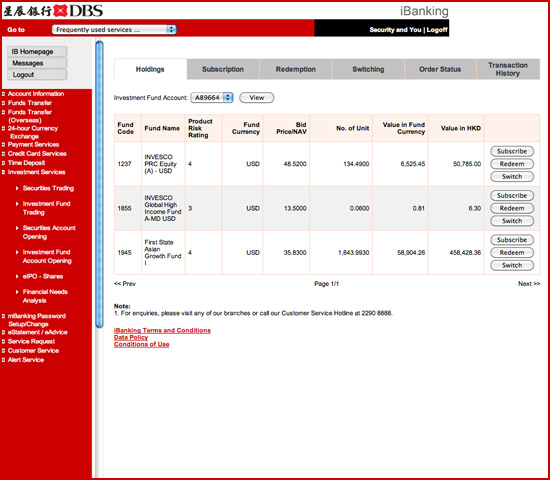

Holdings

|

|

To make a transaction in

respect of your investment fund holdings

| |

Click ‘Subscribe’,

‘Redeem’ or ‘Switch’ button to submit

the relevant instruction. |

|

|

|

|

|

|

|

|

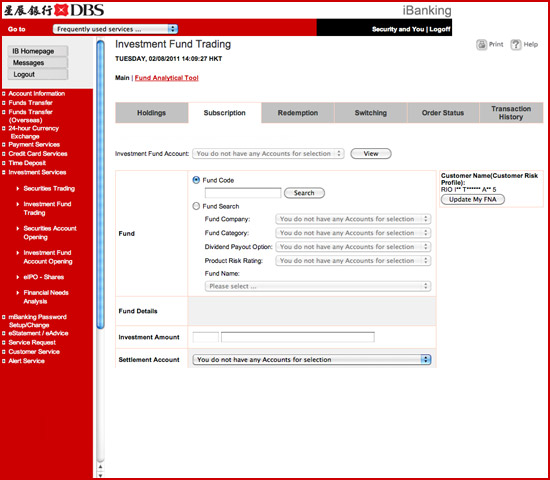

Subscription

|

|

To subscribe investment

funds

| |

Click on 'Update My FNA'

to assess your attitude towards investment risk if your financial

needs analysis expired or has to be updated. |

| |

Enter ‘Fund Code’ or select

‘Fund Search’ to search the investment fund details. |

| |

Enter ‘Investment Amount’

and select ‘Settlement Account’. |

| |

Note:

1. Once the order instruction has been submitted, you cannot

amend/cancel the order online.

|

|

|

|

|

|

|

|

|

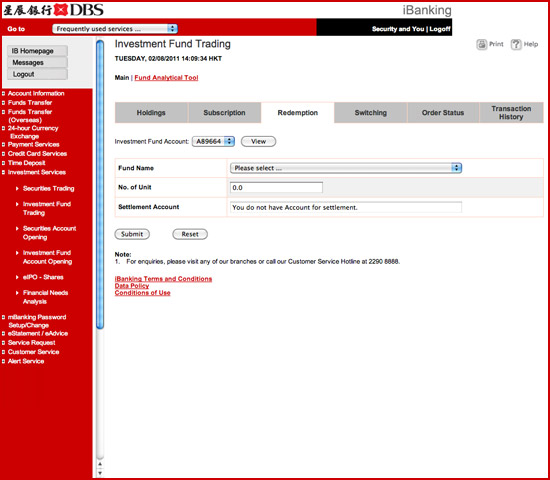

Redemption

|

|

To redeem investment funds

| |

Select 'Fund Name' and

enter 'No. of Unit' to redeem the investment fund |

|

|

|

|

|

|

|

|

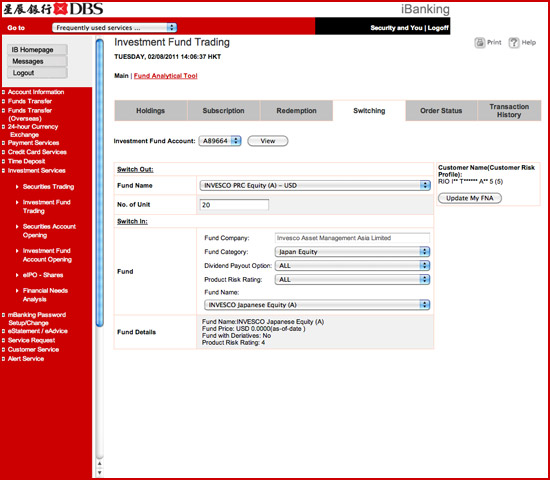

Switching

|

|

To switch investment funds

| |

Input the ‘Switch

Out’ and ‘Switch In’ details |

|

|

|

|

|

|

|

|

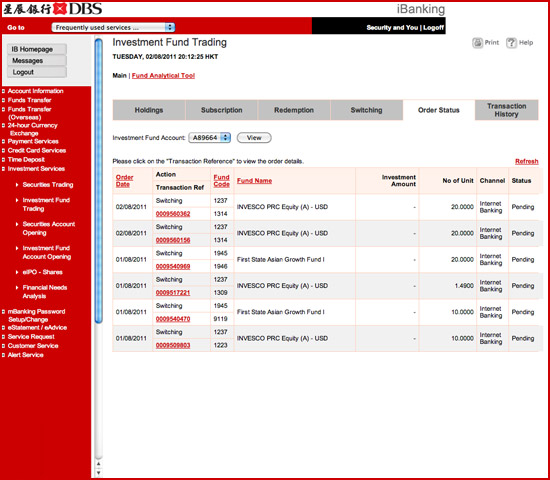

Order Status

|

|

To view the status of your

order

| |

Click 'Transaction Reference'

to view the order details. |

|

|

|

|

|

|

|

|

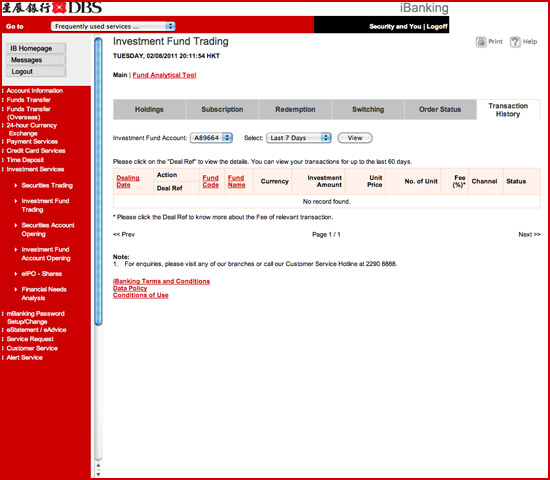

Transaction History

|

|

To view the transaction

history (up to one 60 days)

| |

Click 'Deal Reference'

to view the order details up to the last 60 days. |

|

|

|

|

|

|

|

|

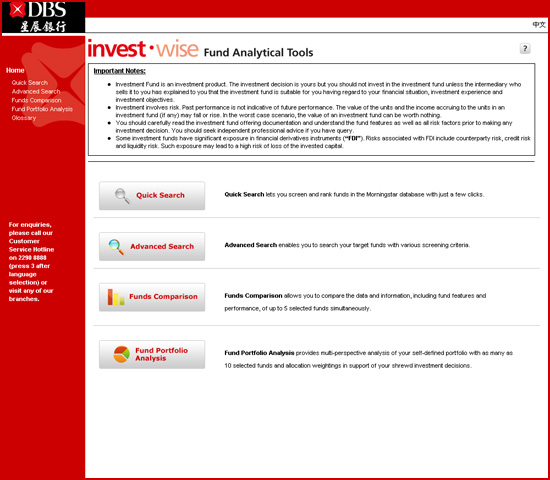

Fund Analytical Tool

|

|

To make your fund selection

easier and quicker, Fund Analytical Tool features the quick/advance

search, fund comparison and portfolio analysis functions. |

|

|

|

|

|

|

|

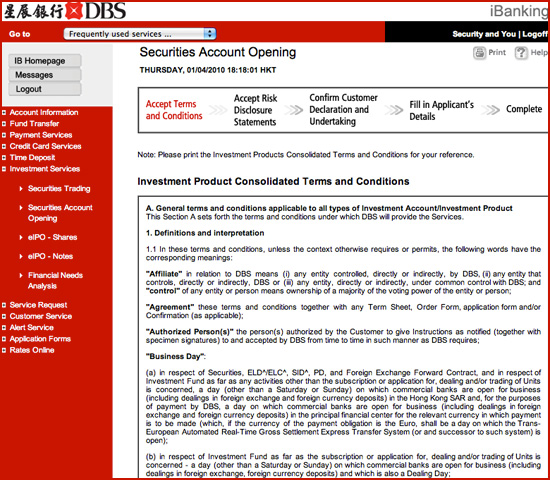

Securities Account

Opening

|

|

If you are a DBS iBanking

customer and a sole holder of a Packaged Account without a Securities

Account, you can submit an application for the opening of a Securities

Account through DBS iBanking.

The steps for opening a Securities Account online:

| |

Accept the Investment Products

Consolidated Terms and Conditions |

| |

Accept the Risk Disclosure Statements |

| |

Make the Customer Declarations and

Undertakings |

| |

Fill in the applicant's details |

| |

Submit the application |

Once your application is successfully submitted,

the account will become effective on the next working day. (If the

application is submitted on a non-working day or later than 2:30pm

of a working day, the securities account will be effective within

2 working days after the day of application). |

| |

|

|

|

|

|

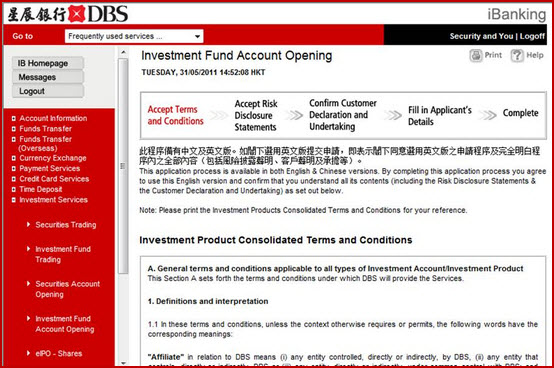

Investment Fund Account Opening

|

|

If you are a DBS iBanking

customer and a sole holder of a Packaged Account and Multi-Currency

Account, you can submit an application for the opening of an Investment

Fund Account through DBS iBanking.

The steps for opening an Investment Fund Account online:

| |

Accept the Investment Products

Consolidated Terms and Conditions |

| |

Accept the Risk Disclosure Statements |

| |

Make the Customer Declarations and

Undertakings |

| |

Fill in the applicant's details |

| |

Submit the application |

Once your application is successfully submitted, the account will

become effective after 4 working days. |

|

|

|

|

|

|

|

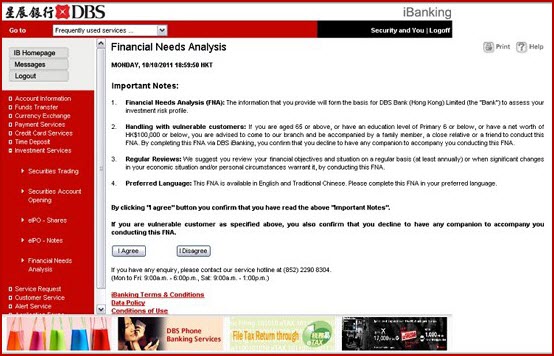

Financial Needs Analysis

|

|

You could complete the

Financial Needs Analysis (FNA) online to review your financial objectives

and situation on a regular basis (at least annually), and help you

assess your attitude towards investment risk. If you are a DBS iBanking

customer with a DBS account, you can conduct the FNA through DBS

iBanking.

The FNA submitted through DBS iBanking will become effective 2 hours

after the submission.

|

|

|

|

|

|