| Section

6 Internet Securities Trading |

|

Q1:

|

How

can I trade Hong Kong stocks through the Internet? |

|

A1:

|

Simply open a Treasures Priority Banking account or DBS Wealth Account with a securities account and register for our DBS iBanking services on the Internet. A Treasures Priority Banking account or DBS Wealth Account and securities account can be opened at any of the DBS branches. If you have any queries, please call our Customer Service Hotline at (852) 2290 8888.

|

|

Q2:

|

What should I do if the securities trading service of DBS iBanking is not responding? |

|

A2:

|

If you are unable to access the service, you can still place your orders using the following alternative trading channels:

- Automated channels:

- Automated Phone Banking Services Hotline (852) 2290 8888 (press 3 then 1 after language selection)

- Manned securities trading hotline:

- Securities Trading Express Hotline (852) 2290 8833; or

- Manned Customer Service Hotline (852) 2961 2338 for TPB customers; or

- Phone Banking Services Hotline (852) 2290 8888 (press 3 then 2 after language selection) for other customers

For any other enquiries, call our Customer Service Hotline at (852) 2290 8888 (press 3 then 8 after language selection). |

|

|

Account Opening |

|

Q1:

|

Can I operate my securities account for trade via the Internet when I am not in Hong Kong? |

|

A1:

|

This can be done provided that you have established Internet Securities Trading facilities with DBS. While you are abroad, you will be subject to the laws of that jurisdiction and are solely responsible to ensure that all transactions you perform over your securities account are in compliance with those laws.

|

|

Q2:

|

How do I open a securities account with DBS? |

|

A2:

|

If you wish to open a securities account, please visit any of our branches or open the account through DBS iBanking.

|

|

Q3:

|

What are the required supporting documents? |

|

A3:

|

To open a personal securities account with DBS, please provide the following supporting documents: :

- A copy of Hong Kong I.D. document (e.g. ID card, passport etc.)

- Proof of home address (e.g. utility bills, Tax Assessment Note, Government Rates Demand Note)

- Written consent from your employer if your employer is a registered person with the Securities and Futures Commission of Hong Kong (HKSFC).

|

|

Q4:

|

What are the steps I have to take to open a securities account online? |

|

A4:

|

Before applying for a securities account, you are required to complete a Financial Needs Analysis (FNA) (Please see Section 8 - Financial Needs Analysis).

The steps for opening a securities account online:

- Accept the Investment Products Consolidated Terms and Conditions

- Accept the Risk Disclosure Statements

- Make the Customer Declarations and Undertakings

- Fill in the applicant’s details

- Submit the application

Once your application is successfully submitted, the account will become effective on the next working day. (If the application is submitted on a non-working day or later than 2:30pm of a working day, the securities account will be effective within 2 working days after the day of application).

|

Q5: |

Why was I not able to submit an application for opening a securities account through DBS iBanking? |

A5: |

This service is only available to holders of a valid HKID or passport and a Packaged Account in his/her sole name who have registered for DBS iBanking and are not holding any securities account with our Bank. Moreover, we do not currently accept online application for securities account opening by the following person(s):

- An employee or a director of a Licensed Corporation or Registered Institution under the Securities and Futures Ordinance; or

- A resident or citizen of the United States of America.

|

Q6: |

Do I need to make any initial deposit to open a securities account? |

A6: |

No. An initial deposit is not required for opening a securities account in DBS. |

| |

Internet Securities Trading |

|

Q1:

|

What can I trade through DBS? |

|

A1:

|

You can trade stocks and warrants listed on The

Stock Exchange of Hong Kong via the Internet. For trading GEM stocks,

you have to complete and sign additional documents before trading.

|

|

Q2:

|

What are the trading hours and can I place order outside trading hours? |

|

A2:

|

The trading hours of securities listed in the Stock Exchange of Hong Kong (the “SEHK” ) are as follows (subject to the trading arrangements as approved by the SEHK or typhoon trading suspension arrangements):

- Pre-opening Session Trading:

9:00am to 9:30am ("At-auction Limit Order" is only allowed to place from 9:00 am to 9:15 am)

- Normal Day Trading:

Continuous Trading Session - 9:30am to 12:00pm and 1:00pm to 4:00pm

- Half-Day Trading:

Continuous Trading Session - 9:30am to 12:00pm

- Closed on Saturdays, Sundays and all Hong Kong public holidays.

You can place new orders, amend order or cancel order at the following service hours:

| Order Type |

Instruction |

Service Hours

(Normal Day Trading) |

Service Hours

(Half-Day Trading) |

At-auction Limit Order

|

Place Order

Amend order

Cancel order |

24 Hours

(except 9:15 am - 4:00 pm)

24 Hours

(except 9:15 am - 9:30 am)

24 Hours

(except 9:15 am - 9:30 am) |

24 Hours

(except 9:15 am - 12:00 pm)

24 Hours

(except 9:15 am - 9:30 am)

24 Hours

(except 9:15 am - 9:30 am) |

Enhanced Limit Order / Stop Loss Order

|

Place Order

Amend order (For Enhanced Limit Order Only)

Cancel order |

24 Hours |

24 Hours |

| Market Order |

Place Order |

9:30am - 12:00pm &

1:00pm - 4:00pm

(The trading hours of morning session and afternoon session) |

9:30am - 12:00pm |

- Any unfilled At-auction Limit Order with input price not deviating 9 times or more from the prevailing nominal price will be converted to Limit Orders at the input price and will be carried forward to the next Continuous Trading Session.

- Enhanced Limit Orders and Stop Loss order submitted before 9:30am or between 12:00pm to 1:00pm will be handled after the Continuous Trading Session opens. For Enhanced Limit order amendment, our system will process your instruction on a first-come-first-served basis on the same order.

- "Good-till-date" function is available for “At-auction Limit Order” “Enhanced Limit Order” and “Stop Loss Order” only.

|

|

Q3:

|

What order type(s) are available

for trading? |

|

A3:

|

You can place "Enhanced Limit Order", "Stop Loss Order", "Market Order" or "At-auction Limit Order" via DBS iBanking.

|

|

Q4:

|

What is Enhanced Limit Order?

|

|

A4:

|

An Enhanced Limit Order (ELO) allows matching of up to ten price queues at a time. The ask order price of an ELO can be inputted at 9 spreads lower than the current bid or the bid order price can be inputted at 9 spreads higher than the current ask price. Any unfilled ELO will be stored in the System as a normal Limit Order at the input order price for queuing.

|

Q5: |

Under what circumstances will an Enhanced Limit Order (ELO) be converted into a Limit Order (LO)? |

A5: |

If your ELO cannot be fully executed, the unexecuted quantity of the ELO after matching will be converted to LO automatically. The LO will be stored in the System at the input order price for queuing until the market closes. The aforementioned order will remains an LO order despite any order is amended subsequently.

* Limit Order (LO) is an order that allows you to set a maximum price for a buy order or a minimum price for a sell order as the order price. |

|

Q6:

|

What is Market Order? |

|

A6:

|

Market Order helps customer to buy/sell securities at the prevailing marketing price immediately without setting a limit price. This order will be placed at the prevailing market price by default. The executed price may deviate considerably from the price the customer expected at time of placing such order. This situation often occurs at the beginning of morning and afternoon trading sessions when there are many accumulated orders to be handled. The executed price will be up to 10 spreads below/above the prevailing BID/ASK price respectively at the time of execution. Any unexecuted quantity of the order after matching will be cancelled immediately. Customers ought to be aware that the order may be rejected or unexecuted if (but without limitation to) the market price fluctuates beyond the said price spreads (i.e. 10 spreads). The order processing time required will depend on the prevailing market situation and the number of orders that need to be processed. Customer ought to be aware of the possible delay of order processing as well as the possibility of incurring great loss by this order type. Customers are advised to enquire the order status after placing order.

The below example illustrates the details of a "buy" market order of a particular stock:

- The price queue of the stock in 15 spreads are shown below:

|

Ask Price

|

Quantity

|

|

1.01

|

6K

|

|

1.02

|

1K

|

|

1.03

|

1K

|

|

1.04

|

2K

|

|

1.05

|

2K

|

|

1.06

|

2K

|

|

1.07

|

1K

|

|

1.08

|

0

|

|

1.09

|

1K

|

|

1.10

|

1K

|

|

1.11

|

1K

|

|

1.12

|

9K

|

|

1.13

|

0

|

|

1.14

|

0

|

|

1.15

|

12K

|

- Nominal Price = 1.01

- Market Order Spread = 10 spreads; the Upper Limit Price = Nominal

Price + 10 spreads = 1.11

- Quantity = 20K

- Orders sent to the market:

|

Order Details

|

Executed Quantity (Price)

|

Rejected

Quantity

|

Total Executed Quantity

|

|

1. Buy 20K at 1.11*

|

6K (1.01)

1K (1.02)

1K (1.03)

2K (1.04)

2K (1.05) |

8K

|

12K

|

|

2. Buy 8K at 1.11*

|

2K (1.06)

1K (1.07)

1K (1.09)

1K (1.10)

1K (1.11) |

2K

|

18K

|

*

Remarks: Orders will be sent to the market in the form of Special Limit Order

.

The order is closed with partially executed status (with total executed quantity 18K) and the outstanding quantity of 2K will automatically be cancelled. That means a market order will be executed for the largest quantity possible until reaching the limit price (i.e. 1.11) and the outstanding unexecuted quantity will automatically be cancelled.

|

Q7: |

What is At-auction Limit Order? |

A7: |

You can place the "At-auction Limit Order (ALO)" during the pre-opening session, with a specified price. It may be matched in price and time priority at final Indicative Equilibrium Price (IEP)* and Indicative Equilibrium Volume (IEV)**.

At pre-opening session, unfilled ALO with input price not deviating 9 times or more from the prevailing nominal price will be converted to Limit Orders at the input price and will be carried forward to the next Continuous Trading Session.

* Indicative Equilibrium Price (IEP) is the price at which the maximum number of shares can be traded if matching occurs. It will be re-calculated every time when a new order is entered to AMS/3 until the end of auction trading session. The final IEP is determined by the Stock Exchange of Hong Kong.

** Indicative Equilibrium Volume (IEV) is the number of shares that can be matched at the IEP. It will be re-calculated every time when a new order is entered to AMS/3 until the end of auction trading session.

|

Q8: |

What is a Stop Loss Order? |

A8: |

Stop Loss Order helps minimize the loss in a volatile market. Basically it is a sell order with a pre-set selling price range, i.e. the Stop Loss Price and the Lowest Selling Price, for the securities you designate. Once the current nominal price of the securities hits your pre-set Stop Loss Price, your sell order will be placed to the market at the prevailing market price (i.e. sell order is triggered). The Bank will try to process your order but does NOT guarantee that the order will be executed, due to fluctuation in stock price, insufficient market liquidity, system failure or event beyond the control of the Bank. The order may be fully executed, partially executed or unexecuted. The executed price may also be HIGHER THAN, EQUAL TO OR LOWER THAN your pre-set Stop Loss Price, but will NOT be LOWER THAN the Lowest Selling Price. Once the Stop Loss Order is triggered on a trading day, whether it is partially or wholly unexecuted, the order will lapse upon expiry of that trading day and not be carried forward to next trading day even the Good-till was set. |

Q9: |

What if the Stop Loss Order cannot be executed at the pre-defined Lowest Selling Price? |

A9: |

If the order is not executed even at the Lowest Selling Price, such Stop Loss Order will be converted to an Enhanced Limit Order at the Lowest Selling Price and will be placed to the market for queuing. Such Enhanced Limit Order will lapse upon expiry of a trading day whether it is partially or wholly unexecuted on that trading day and it will not be carried forward to next trading day. |

Q10: |

What is the range for Stop Loss Price and Lowest Selling Price acceptable to our Bank? |

A10: |

Our Bank only accepts a Stop Loss Price set within the range of 11 spreads and 50 spreads (the Bank reserves the right to change the acceptable range for Stop Loss Price without notice) below the current Nominal Price but it must not be lower than HKD0.01. The Lowest Selling Price can be Lower Than or Equal To the Stop Loss Price but it cannot be lower than HKD0.01. We also do not accept any Stop Loss Order if the current nominal price of such stock is lower than HKD0.02. |

Q11: |

How does Stop Loss Order work? |

A11: |

Please see the illustration below:

|

Q12: |

Can I amend a Stop Loss Order? |

A12: |

No, you cannot amend a Stop Loss Order once it is submitted. However, if a Stop Loss Order is still pending for execution, you can cancel the order first. After that order is cancelled, you can place a new order again. Only the outstanding Stop Loss Order can be cancelled. |

|

Q13:

|

Under what circumstances will my order placed via DBS iBanking be rejected? |

|

A13:

|

Your order will be rejected under any of the following circumstances (for illustration only and not exhaustive):

- You do not have sufficient funds for your buy order; or

- You do not hold the stock or you have insufficient stocks for your sell order; or

- The buy/sell stock price is 100 spreads above / below the market price for ELO and 20 spreads above / below the market price for ALO; or

- Your order quantity is greater than 3,000 board lots; or

- The order you want to amend / cancel has been executed; or

- Your amended buy/sell order price is 100 spreads above / below the market price for ELO (except for orders that have already been submitted to HKEX and which when your amended buy/sell order price is 20 spreads above / below the market price) and 20 spreads above / below for ALO; or

- Your inputted order price of an ELO is beyond 4 best price spreads from the current price of the other side of the market (i.e. 5 bid/ask spreads); or

- Your order price / amended order price is not valid depend on the prevailing market situation, e.g. price fluctuation; or

- Your order amendment is the same as the original order; or

- The stock has been suspended; or

- Any other reason of rejection provided by the the Stock Exchange of Hong Kong.

|

|

Q14:

|

How shall I know whether my instruction has been received or not? |

|

A14:

|

After you entered and confirmed your instruction details, a reference number will be given for your instruction. This only acknowledges the Bank's receipt of your instruction. There is no guarantee that your instruction will be processed or executed in the market. Your instruction may be rejected or not be executed due to fluctuations in stock price, insufficient market liquidity, system delayed/failure or any other event beyond the control of the Bank. You can check the status of your instruction under 'Investment Services' > 'Securities Trading' > 'Main' > 'Order Status'.

As the initial order remains queuing in the market pending processing notwithstanding subsequent placement of an amendment order or cancellation order, such amendment order or cancellation order may not be transacted or processed. You are advised to check your order status under 'Investment Services' > 'Securities Trading' > 'Main' > 'Order Status '. |

Q15: |

Under what circumstances Market Order will be rejected by the market? |

A15: |

Since the upper limit price of a Market Order can only be set within 10 spreads below/above the prevailing BID/ASK price respectively at the time of execution, the order may be rejected or unexecuted if (but without limitation to) the market price fluctuates beyond the said price spreads (i.e. 10 spreads). This situation may happen occasionally, especially when the stock market is volatile. |

Q16: |

After I have placed an order via an automated channel, I cannot receive any order reference number. What can I do? |

A16: |

You can enquire the order status via DBS iBanking (under 'Investment Services' > 'Securities Trading' > 'Main' > 'Order Status '), or by calling our Phone Banking Services Hotline at 2290 8888 (press 3 after language selection). To avoid placement of duplicated order(s), please do not place another order until your previous order has been confirmed to be invalid.

For the order status enquiry details, please refer to Q12. |

Q17: |

How can I check my order status

and what is its meaning? |

A17: |

You can check your

order status via:

- DBS iBanking under “Investment Services” >

“Securities Trading” > “Main” >

“Order Status”; or

- Phone Banking Services Hotlines:

- Manned Customer Service Hotline (852) 2961 2338 for TPB customers;

or

- Phone Banking Services Hotline (852) 2290 8888 for other

customers

The meaning of the order status is summarised below for your easy

reference:

| Order Status |

Details |

| Pending |

Your instruction is

received but not yet sent to the market. If your instruction

cannot be sent to the market or accepted by the market after

the market opens, the status will change to 'Rejected'. You

can check 'Order Status' and register

for 'Securities Order Confirmation' to obtain the latest status

of your order. |

Queuing

(from 09:00 until the market opens on a trading day) |

Your instruction is

received but is pending to be sent to the market. The status

will change to 'Rejected' if your instruction cannot be sent

to the market or accepted by the market after the market opens.

You can check 'Order Status' and register

for 'Securities Order Confirmation' to obtain the latest status

of your order. |

Queuing

(after the market opens on a trading day) |

Your instruction has

been sent to the market for queuing. You can check 'Order

Status' and register for 'Securities Order Confirmation' to

obtain the latest status of your order. For amendment order

or cancellation order, your instruction may not be processed

in the market. You can check ‘Order Status’ and register for 'Securities Order Confirmation'

to obtain the latest status of your order/instruction. |

| Executed |

Order has been executed according to your instruction. |

| Partially Executed |

Your order has been executed partially and the unexecuted quantity will be stored in the system for queuing until the market closes. If the order cannot be fully executed by the time of market closes, the unexecuted quantity will be cancelled. The status of such order will then be changed to 'Executed'. |

| Cancelled |

Order has been successfully cancelled according to your instruction or automatically cancelled at the day-end when the market closes. |

Rejected

(placing new order) |

Your instruction has

been rejected. It cannot be sent to the market or accepted

by the market. You can check ‘Order Status’ and register for ‘Securities Order Confirmation’

to obtain the latest status of your order. You can place a

new order if you wish. |

Rejected

(amending order/canceling order) |

Your instruction has

been rejected. It cannot be sent to the market or accepted

by the market. You can check ‘Order Status’ and register for ‘Securities Order Confirmation’

to obtain the latest status of your order. |

|

Q18: |

If my order has only been partially filled, will the system fulfill my remaining quantity on the next business day? |

A18: |

No, if your order was only partially filled. The remaining order quantity will be automatically cancelled at day end when the market is closed. |

|

Q19:

|

How long will my orders stay valid during the trading day? |

|

A19:

|

Basically, if your order is placed during trading hours and accepted by The Stock Exchange of Hong Kong (the “SEHK”), the order will be valid until the market closes on that trading day. However, if your order is rejected by SEHK after its submission to the SEHK, the order will be invalid immediately upon such rejection and will not be re-submitted to the SEHK again.

You can also set your order expiry date from the list of dates provided under the “Good-till-date” function on the order placement page. Orders within the spreads* as prescribed by the Bank from time to time of the relevant current market bid/offer prices will be sent to the SEHK for queuing during the specified order period until the end of the order expiry date unless such orders are cancelled by you.

You can also set your order expiry date from the list of dates provided under the “Good-till-date” function of the order placement page. Orders within the spreads* as prescribed by the Bank from time to time of the relevant current market bid/offer prices will be sent to the SEHK for queuing during the specified order period until the end of the order expiry date unless such orders are cancelled by you.

*For ELO, only orders within 15 spreads of the current market bid/offer prices will be sent to the SEHK for queuing, whereas for ALO, only orders within 20 spreads will be sent to the SEHK for queuing.

|

Q20: |

I have cancelled the order via an automated channel and got the message "the instruction has been accepted". Why it still gets executed anyway? |

A20: |

Although the cancel instruction is accepted by the bank, the order may take time for routing to the Stock Exchange of Hong Kong. Therefore, your orders may have already been executed before the cancellation instruction can take effect.

|

|

Q21:

|

What fees, levies, etc. will be charged for trading? |

|

A21:

|

Please refer to our Bank's Fee Schedule via www.dbs.com/hk under 'Rates/Fees' > 'Bank Charges'.

|

|

Q22:

|

Can I sell shares that are bought on the same trading day? |

|

A22:

|

Yes. You can sell your purchased shares on the same trading day (as long as the buying and selling are done through us).

|

|

Q23:

|

Can I use the fund receivables from the stocks I sold to buy a new stock before the sold stocks settled on T+2* day? |

|

A23:

|

Yes. Our system will first hold the amount required for your new buy order from the receivable fund of your sell order (before the stocks settled on T+2 day). If the amount of your buy order is larger than the amount of receivable fund, the remaining balance will be held from your account to be debited according to your instruction. On T+2 day, the amount required for your buy order will be deducted from your settlement account and the remaining balance, if applicable, will be debited from your account which you instructed.

* The Stock Exchange of Hong Kong Participants are required to settle with the Central Clearing and Settlement System (CCASS) all transactions concluded through AMS/3 before 3:45pm on the second Settlement Day following T-day (the transaction day). This day is known as T+2.

|

Q24: |

Will funds being withheld from my settlement account once my buy order is placed? |

A24: |

Basically yes. The required funds will be withheld from your settlement account once your order had been placed.

If you place an order within any of the below time periods, we will withhold the required funds from your settlement account on the commencement of the next business day. However, if you do not have sufficient fund in your settlement account on the next business day, your order will be rejected due to insufficient fund in the settlement account.

| Monday to Saturday and Unexpected Holiday |

9:00pm - 7:00am |

| Sunday and Public Holiday |

Full day |

|

Q25: |

How can I enquire the available balance of my settlement account (i.e. Current Account) and the amount of receivable fund from the stocks I sold (before settlement on T+2 DAY)? |

A25: |

You can enquire the available balance of your settlement account and the amount of receivable fund under 'Investment Services' > 'Securities Trading' > 'Main' > 'Place Order' > 'Quick Fund Transfer' of DBS iBanking.

|

Q26: |

Can I place odd lot/special lot order via an automated channel? What is the brokerage charge for placing odd lot or special lot? |

A26: |

No. You can only place odd lot or special lot order via our Manned Securities Trading Hotlines.

For brokerage charge, please refer to our Bank's Fee Schedule via www.dbs.com/hk under 'Rates/Fees' > 'Bank Charges' ('Brokerage Commission' under 'Investment Services – Securities').

|

|

Q27:

|

What is short selling? Can I short-sell

with DBS? |

|

A27:

|

Selling shares that you do not own is short selling.

In compliance with Hong Kong regulatory requirements,

our bank does not allow short selling

.

|

Q28: |

Can I trade with a joint Securities Account via the DBS iBanking? |

A28: |

You can trade with your joint Securities Account via DBS iBanking by adding your joint account(s) to your DBS iBanking profile. You can apply the service at our branches in person by completing the 'DBS iBanking Application Form'. The form can be downloaded via www.dbs.com/hk under the 'Form' section. |

| |

Dual Tranche, Dual Counter Model |

|

Q1: |

What is Dual Tranche, Dual Counter (DTDC) Model? |

|

A1: |

Introduced by The Hong Kong Exchanges and Clearing Limited (HKEx), the DTDC model allows offering and listing of two tranches of shares by the same issuer in different trading currencies (ie. HKD and CNY). Both of the tranches, under the same class, will be traded on the Stock Exchange of Hong Kong in HKD and RMB counters respectively. A stock holder who holds shares in one counter can transfer the shares to another counter. For details, please refer to HKEx’s website. |

Q2: |

Under the DTDC mechanism, how to distinguish between the two counters of shares of the same company? Is there any difference between their stock codes? |

A2: |

The two tranches of shares will carry different stock codes. The 5-digit stock code for the HKD counter shares will start with “0” while RMB counter‘s 5-digit stock code will start with “8”. The last four digits of the two stock codes will be the same.

The stock short names for the two counters are also different. For the RMB counter, the stock short names will end with “–R” to indicate that the shares are traded in CNY. There will be no specific marking in the stock short names of the HKD counter shares.

|

Q3: |

What do I need in order to trade DTDC stocks? |

A3: |

You are required to have a packaged account, a securities account and a Renminbi savings account. Please note that no relevant trading order will be processed if there is no sufficient amount of CNY in the Renminbi savings account. |

Q4: |

If I am holding HKD counter shares, when can I sell them in the RMB counter? |

A4: |

If you are holding HKD counter shares, you can sell them in the RMB counter at any time and vice versa, without having to wait for days to transfer the shares to the other counter beforehand. |

Q5: |

Can I buy HKD counter shares and then sell them in the RMB counter immediately? |

A5: |

Yes, after you have successfully purchased the HKD counter shares, you can sell them in the RMB counter immediately and vice versa, without having to wait for days to transfer the shares to the other counter beforehand. |

Q6: |

How can I conduct cross-counter trading of shares? |

A6: |

You can perform the transaction either through our manned channel or automated channels. Please make yourself ready with the relevant stock codes and choose the currency in which the transaction would be settled. |

Q7: |

Can I buy RMB-traded shares using HKD funds? |

A7: |

No, you have to do a FX transfer to your Renminbi savings account first. After the funds are ready to use, you can proceed to purchase RMB shares. |

Q8: |

What are the charges for transferring HKD-traded shares to RMB-traded shares or vice versa? |

A8: |

A DTDC transfer fee of HKD30 will be charged for each counter transfer. |

Q9: |

Will the daily exchange limit for RMB still apply to DTDC? |

A9: |

The daily exchange limit of CNY20,000 will not apply to DTDC. |

|

Q10: |

In which currency will I receive dividends? |

A10: |

It depends on the dividend policy of the issuer. |

|

Q1:

|

What types of information can

be obtained in 'Market Information' ? |

|

A1:

|

You can gain access to major indices, real time detailed quote, top movers, research, market news and announcements, warrants and IPO information. The service is free of charge and best viewed with below browsers:

|

|

|

|

i) For Microsoft Windows: |

|

- Internet Explorer 8.0

- Firefox 11

- Chrome 23

|

|

|

|

ii) For Apple Mac OS: |

|

|

Q2: |

Is there any charge for the real-time snapshot quotes service? |

A2: |

Currently, the real-time snapshot quotes service is free-of-charge until further notice. |

Q3: |

How does the "quote counter" work? For example, when the number of quote counter is '0 / 1000', what does it represent? |

A3: |

The first figure ('0') shown in the “quote counter” indicates the number of the real-time snapshot quotes* ('real-time quotes') you have used so far in the current month. This figure will increase by 1 each time a real-time quote is used. If this figure is '0', that means you have not used any real-time quotes so far in the current month.

The second figure ('1,000') is the total number of the free real-time quotes you may use in the current month (the 'designated number'). Since the real-time snapshot quotes service is free at the moment, you will not be charged if you have used more than the designated number. This figure will be reset at the beginning of each month and the unused free real-time quotes of any month will not be carried forward to the next month.

*All real-time quotes used between 09:00 and 12:15 and between 13:00 and 16:15 on any trading day (for Exchange Traded Funds under the Pilot Programme - from 09:00 to 16:00) will be reflected in the quote counter.

|

Q4: |

Why was I not able to access to "Market Information" in Securities Trading? |

A4: |

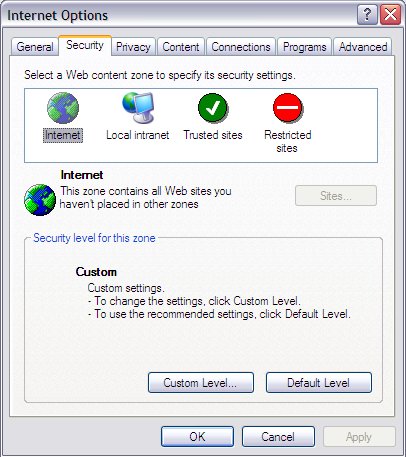

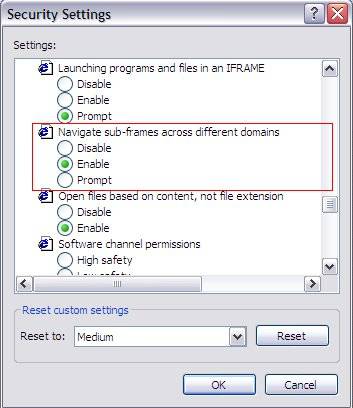

It may be caused by wrong web browser setting. For Internet Explorer, please follow the steps below to solve the problem:

1. Select "Tools", then click on "Internet Options"

2. Choose the tab of "Security"

3. Select "Internet" in the web content zone and then click on "Custom Level"

4. Select "Enable" in "Navigate sub-frames across different domains", then click on "OK"

|

Q1: |

Can I enquire my stock holdings balance via DBS iBanking? |

A1: |

Yes. You can enquire your stock holdings under 'Investment Services' > 'Securities Trading' > 'Main' > 'Place Order' > 'Holdings'. The stock holdings under 'Securities Trading' shows your most updated stock holdings. You can also check the balance of your Securities Account under 'Account Information' > 'Account Summary' which will be updated around 1 business day after the stocks are settled on T+2* day.

* Stock Exchange of Hong Kong Participants are required to settle with the Central Clearing and Settlement System (CCASS) all transactions concluded through AMS/3 before 3:45pm on the second Settlement Day following T-day (the transaction day). This day is known as T+2. |

Q2: |

How can I calculate the gain/loss

of my stock holdings? |

A2: |

To

calculate the gain/loss of your holdings in a particular stock,

please input the “Average Purchase Price” under ‘Investment

Services' > 'Securities Trading' > 'Main' > 'Place Order'

> 'Holdings' and press “Save and Calculate”. The

result will be displayed under the “Gain/Loss” column.

You can re-enter the “Average Purchase Price” and press

“Save and Calculate” to update the gain/loss.

|

| |

Securities

Order Confirmation Service |

Q1: |

How can I start using Securities

Order Confirmation service? |

A1: |

You

can set up your Securities Order Confirmation service instantly

via DBS iBanking by selecting “Alert Service” >

“Securities Order Confirmation” from the menu and complete

the steps as instructed.

Alternatively, you can complete the Alert Service Request Form and

submit it to any of our branches in person to complete the setup.

For more details, please refer to Section 9 (Alert Service).

|

|

Q1:

|

When should I settle trades? |

|

A1:

|

You need to have sufficient funds / stock holdings

in your settlement account on the day that your order(s) is/are

placed. The money deposited into your settlement account will earn

interest at the prevailing savings rate before settlement (T+2).

The Bank will automatically credit and debit the transaction proceeds

via your settlement account on T+2.

|

|

Q2:

|

How can I deposit stocks to my

DBS Securities Account? |

|

A2:

|

For deposit of physical scrip, please fill in the "Deposit Form of Securities" (please download the form via www.dbs.com/hk under 'Forms') and bring the scrip to our office of Investor Services Operations Department. For your own protection, we recommend that you should not sign on the back of the physical scrip until you have arrived at our office. The address is: 11th Floor, Millennium City 6, 392 Kwun Tong Road, Kwun Tong, Hong Kong. Office Hours: 9:30am - 5:30pm on Mondays to Fridays.

Please remember: Stocks will cease to be registered in your name after such deposit. So you will cease to enjoy any loyalty bonuses or benefits that require continuous personal ownership (e.g. Tracker Fund). If in doubt, please contact our Customer Service Hotline on 2290 8888 (press 3 then 8 after language selection).

|

|

Q3:

|

How can I withdraw stocks from

my securities trading account? |

|

A3:

|

Simply go to a branch to fill in and sign a "Securities

Withdrawal Form". Our branch staff will then handle the stock withdrawal

on your behalf.

|

| |

Corporate Action

/ Nominee Services |

|

Q1:

|

How can I receive company dividends? |

|

A1:

|

As long as your stock is kept at DBS, we shall

receive the dividend on your behalf before crediting the amount

into your account. An administrative charge (as shown on the Fee

Schedule) will be levied.

|

|

Q2:

|

What should I do if I lose my

physical scrips? |

|

A2:

|

You should report the loss to the police and then

contact the share registrar of the listed company for the issuance

of new share certificates.

|

|

Q1:

|

What types of information can

be obtained in 'Stock Watch' and what is the monthly charge of this

service? |

|

A1:

|

You will be able to access the following information:

- Streaming real-time quotes with broker queues

- HSI with turnover

- HS Future Indices with volume

- Historical charts with technical analysis tools

- The Stock Exchange of Hong Kong financial news and result announcements

- Top 10 ranking

'Stock Watch' service is provided by QuotePower International Ltd.

(QPI). For Treasures Priority Banking accounts, a monthly fee of

HK$238 will be charged. For DBS Wealth Account / ec-payroll account,

a monthly fee of $288 will be charged. Please note that it will

take 2 business days to process your request.

|

|

Q2:

|

Will the financial information

be updated itself or do I need to press a button from time to time

to update the data? |

|

A2:

|

The financial information is updated automatically

using data streaming. You do not need to press any button to refresh

the information.

|

|

Q3:

|

Where does the market

data come from? |

|

A3:

|

All of our Hong Kong stock quotes are directly

fed by the Stock Exchange of Hong Kong while quotes for Hang Seng

Index Futures by the Hong Kong Futures Exchange Ltd. For a complete

list of our information vendors, please visit the following website

at:

http://www.quotepower.com/english/ipd/ipdvendor.asp

|

|

Q1:

|

How can I access Stock

Watch Service via a browser over the Internet? |

|

A1:

|

To enjoy all the advanced features of Stock Watch Service, your browser should be Internet Explorer to operate properly. For the Stock Watch Service, you will experience a download time of around 1 minute.

|

|

Q2:

|

What are the minimum system requirements for my PC to use the Stock Watch service? |

|

A2:

|

Please find the hardware and software requirements here.

To load Stock Watch Service, please ensure that Sun Java VM included with your Internet Explorer is the latest version. To find out whether you have installed Sun JVM, please click here.

|

Q3: |

Are there any settings required if a proxy server is used for Internet connection?

|

A3: |

For Internet connection using a proxy server, the following settings are required:

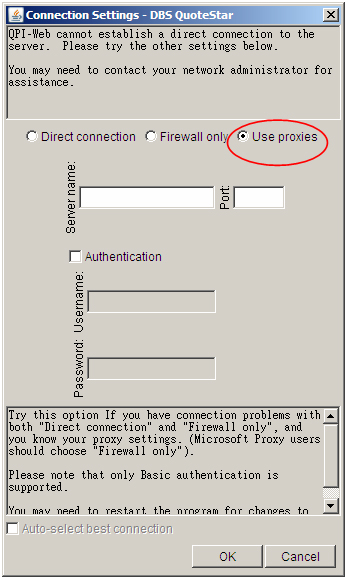

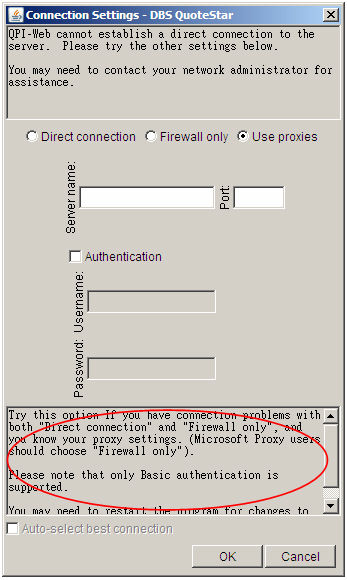

| 1. |

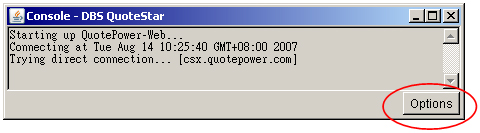

Start the “Stock Watch” service. |

| 2. |

Wait until the window below pops up, and then press the “Options” button.

|

| 3. |

Select the “Use Proxies” option.

|

| 4. |

(Optional) For faster connection, uncheck the “Auto-select best connection” option by clicking on the text area circled in red, and then hitting the “A” key.

|

| 5. |

Press the “OK” button.

|

| 6. |

Restart the “Stock Watch” service |

|

|

Q1:

|

What kinds of CHARTS

do you have and do you have CHARTS for Hong Kong Stocks, Hang Seng

Index and Futures, etc.? |

|

A1:

|

We have the following types of charts:

- Historical Daily, Weekly, and Monthly charts for HK stocks (enter

stock code: '0001', '941', etc.)

- Historical Daily, Weekly, and Monthly charts for Hang Seng Index

and Futures (enter symbol 'HSI' and 'HFI' respectively)

For complete stock code list of the Hang Seng Index and Futures,

please go to:

http://appymt.quotepower.com/web/help/symbol_e.html

|

|

Q2:

|

Can I adjust the parameters

for the different study charts? |

|

A2:

|

YES, you are free to set your own parameters for

Simple Moving Average, RSI-Wilder & RSI-SMA, MACD, OBV, DMI and

slow/fast Stochastics charts. When you click the yellow button with

a hammer and screwdriver on our 'Chart Analysis' page, you

will be able to set the parameters yourself for the above study

tools.

|

|

Q3:

|

Can I see the name

of brokers in the Bid/Ask Broker Queues? |

|

A3:

|

YES. You can point your mouse over the broker number

in the Bid/Ask Broker Queue and then you will be able to see the

broker names at the right hand bottom.

|

|

Q4:

|

What is the information

shown under the Bid/Ask Columns (eg. "#Announcement-P.5654/P.6616,

#Suspended-P.5665")? |

|

A4:

|

If you see, for example, "#Announcement-P.5654/P.6616,

#Suspended-P.5665", they are the page reference numbers released

by the Stock Exchange of Hong Kong (the "SEHK") indicating special news such

as announcements or stock suspension. You cannot directly see such

piece of information by typing in those page numbers; instead, you

can find them from our 'News' page.

To find the news from the 'News' page, select the 'SEHK' button

and the specific stock code. What you have done is to choose to

show only the SEHK news related to the particular stock number that

you typed. (This works in most cases, but sometimes some news may

not be shown due to failure of those listed companies to submit

such news to the Hong Kong Exchange and Clearings Limited).

|

|